Downsizing your house.

Downsizing Your Home: 3 Money Benefits

If you think moving up in life means buying a bigger home, it’s time to set the record straight. Most American families have plenty of room to downsize their home without cramping their style.

Consider the numbers: The average new single-family home comes in at nearly 2,300 square feet, according to National Association of Realtors. You may not think that’s all too big until you look back at history. The National Association of Realtors also reports that the average home size in 1950 was less than 1,000 square feet—and families were bigger back then. By those standards, today’s homeowners are living large!

Moving into a smaller home may feel like a step down, but a closer look reveals quite a few upsides. Are you ready to find out if downsizing is right for you?

Downsizing Your Home: Less Is More

One question we always hear when the topic of downsizing comes up is: “Where will I put all my stuff?” Here are a few ideas: your neighborhood yard sale, eBay, or Craigslist. That’s right—sell it and take that money to the bank, baby!

Sure, a smaller home means less space, but it also means less time, stress and money spent on upkeep. Think of all the fun you could have if you didn’t have to polish your miniature unicorn collection every weekend. You just might find a whole new world outside your door!

Downsizing your square footage might mean your family has to gather around one TV at night instead of spreading out across three or four different rooms (Gasp!). But is more time with the ones you love really all that bad? It just might be the kick in the pants you need to spend more quality time together!

Let’s Cut to the Financial Chase

Still not convinced? Then it’s time to bring out the big guns and talk money. What if you reduced your mortgage by $500 a month and put that cash toward other financial goals? Check out three strides you could make:

1. Attack Your Debt Snowball

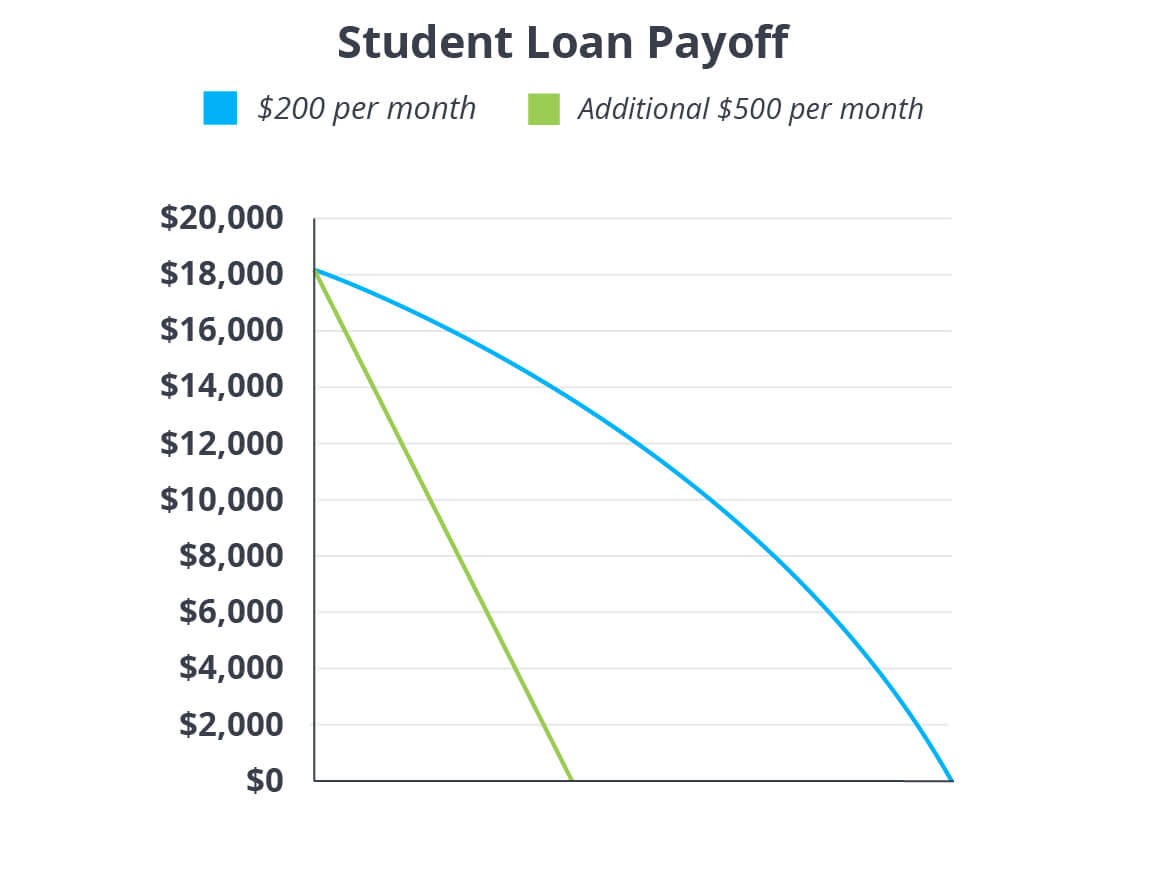

If you’re working hard to kick debt to the curb, downsizing your home can help you maintain that gazelle intensity. Let’s say you owe $18,000 on your student loan. With a 6% interest rate and a minimum payment of $200 a month, you’ll be paying on that loan for 10 more years!

But throw an additional $500 at your loan each month, and you’d trim a whopping seven years and eight months off your pay-off date. Sallie Mae will have to find a new place to live, because you’ll be free from student debt in less than two-and-a-half years!

2. Boost Your Retirement Fund

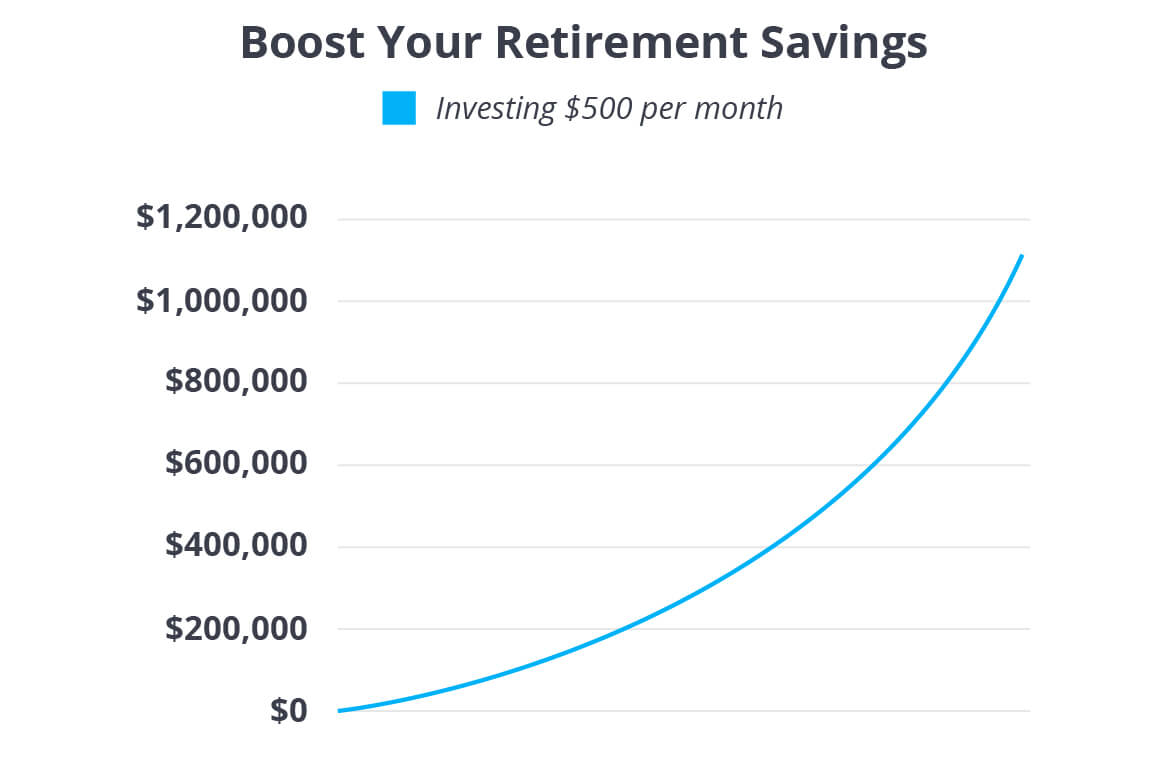

Once you’re debt-free with a fully funded emergency fund, it’s time to build wealth for the future. Dave recommends investing 15% of your household income into Roth IRAs and pretax retirement plans. If you’re still working your way up to 15%, that extra $500 could be the push you need to get there. And, boy, the difference $500 could make! In 30 years, you could have an additional $1–1.6 million in the bank to get you through your golden years. You can do a lot of living and giving with that nest egg!

3. Pay Off Your Mortgage

Want to downsize Dave’s way? Trade in your mortgage for a paid-off home! Use the proceeds from selling your current home to pay cash for a smaller one. Just imagine what you could do with no mortgage holding you down!

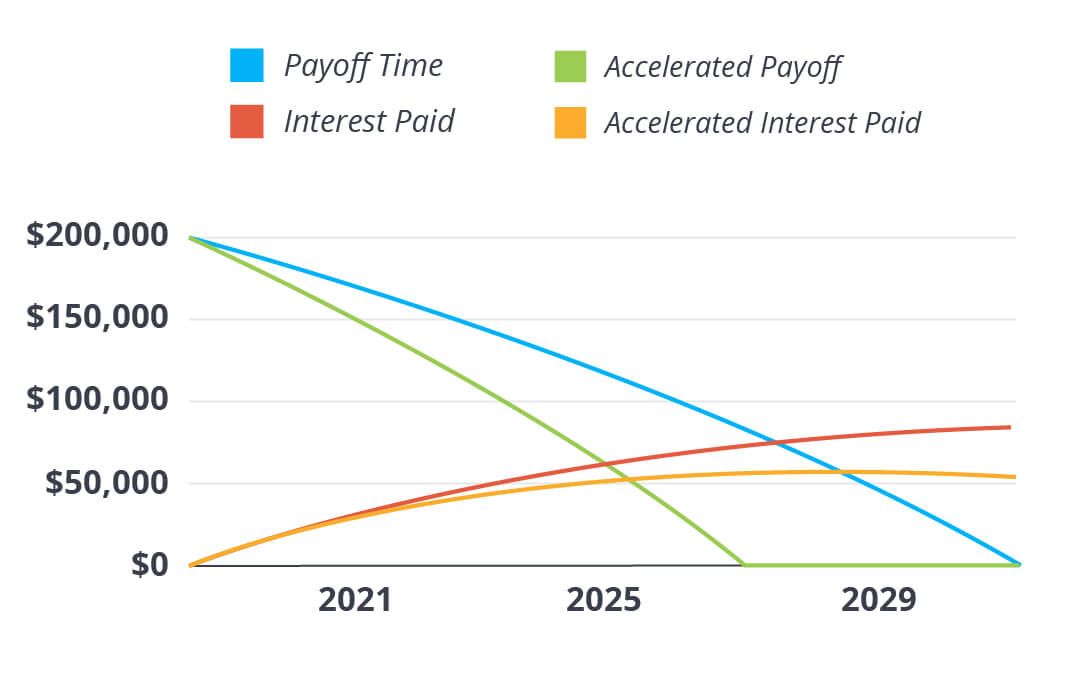

If you can’t pay cash, aim for a 15-year, fixed-rate mortgage and put at least 10–20% down on your new home. Apply the $500 you saved from downsizing to your new monthly payment. At 4.5% interest, you could pay off a $200,000 mortgage in less than 10.5 years, saving almost $25,278 in the process. Cha-ching!

Ready to Downsize? We’ll Show You Where to Start.

Downsizing might not make sense in every situation, but it’s worth a look if saving money and simplifying life appeal to you. Ask an experienced real estate agent to help you determine what your home is worth and show you options for cutting costs. A true pro knows what it takes to get top dollar for your current home and negotiate the best deal on a new one. Ready to downsize but don’t know where to start?

Comments

Post a Comment